I’ve written about the value of moving parts of your company offshore to reduce costs. But what does that actually look like for a tech company in 2020? And how much can you actually save?

To illustrate exactly what you can expect moving business functions offshore, I’ve prepared a case study using a generic SaaS company structure as an example.

While these costs aren’t prescriptive or guaranteed, this method of moving business areas to remote locations based on cost isn’t new… and it certainly isn’t limited to large corporations.

Fast-growing mid-size SaaS companies like Miro, Zapier, as well as international agencies like my own employer Rootstrap, all use this model today to access better talent at lower prices.

Case Study: Offshore Strategy for a Tech Company

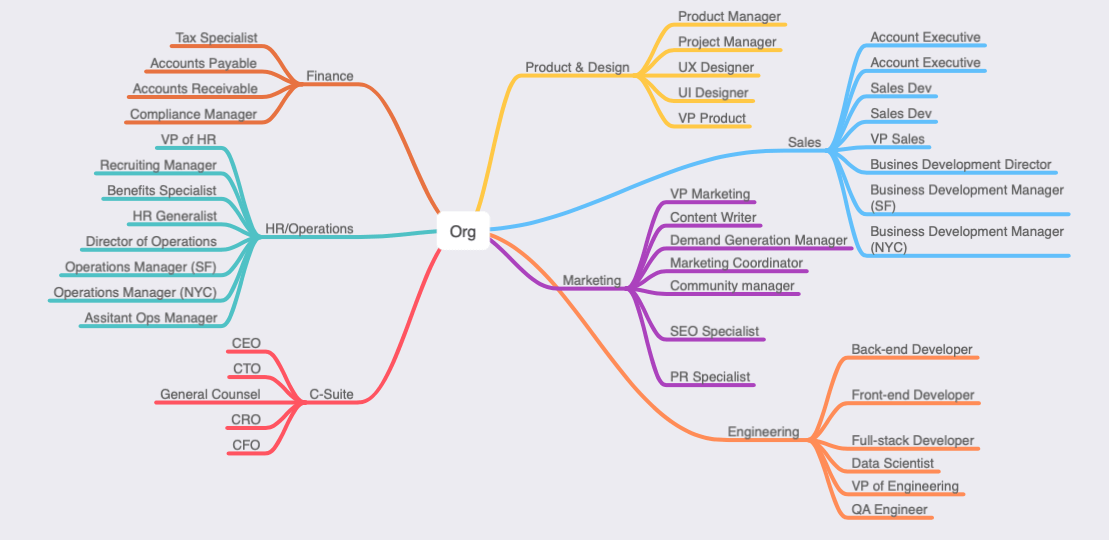

For the sake of illustration, let’s start with a B2B SaaS company based in San Francisco. This org chart is lean, but not unrealistic:

In order to move this organization offshore we need to answer the following questions:

- What roles can be eliminated or automated?

- What roles can be moved to a lower-cost domestic location without reducing quality?

- What roles can be moved to a lower-cost offshore location without reducing quality?

Approach: Multi-branch vs distributed team

There are two basic approaches to moving an organization offshore: multi-branch or distributed team.

The cost benefits are similar, regardless of whether you go fully remote or establish international office locations.

For larger companies, the management overhead of a fully distributed team will likely be too high. Some small to mid-size companies like BaseCamp are famously fully remote. The benefit of keeping physical offices is that you have mini-teams working together with all the benefits of a controlled environment with fluid communication.

Keeping branch offices or “clumping” teams by location can also be helpful for reducing the complexity of international payroll.

Strategy: High-level functions in-office, departments located based on time zone and talent pipeline

Before we dig into the line items, here’s a summary of how we’ll approach the challenge:

1. Keep the higher level functions in-house.

That means directors and senior executives; in essence, your leadership team. The philosophy behind this is that those are the most knowledgeable members of the company.

They’ve been there the longest—perhaps they founded the company—and they know your clientele best.

2. Mid-level management should mostly follow the department.

We’ll be moving most departments offshore, so we need mid-level management to follow and run the ship for each department. Aside from reducing cost, this will make sure we have strong leadership in place at each location.

3. Individual contributors will be in remote offshore offices.

Core contributors like developers, data scientists, copywriters — all these roles can be moved offshore so long as we have good management in place. We could move many of these to freelance remote contractors, but I’ve found full-time in-office locations to be the most effective (especially for client work and agency models).

4. All lower-level processes will be moved to freelance contractors

Automation is growing faster than most enterprises realize in 2020. Just do a search for “no-code automation” or “Zapier expert” on UpWork and you’ll see what I mean. For this case study, we’re going to aggressively move any lower-level functions that we can into offshore processes and/or plug into third-party services or automation.

Structuring a Business with Offshore Components

Below is a list of business components along with what roles are needed, how many of each role are needed, and how much you can expect to spend on them.

As we compare the costs of onshoring versus offshoring, keep in mind that the information below represents base salaries per annum. I’m making this distinction because the data on base is highly accessible, making it a good starting point for research.

We are not including bonuses or stock options. The example I’m dissecting does not represent the aggregate of all of your costs. Overhead, administration, tax costs, offices and more can certainly add up in a less predictable fashion. Fixed costs are easier to determine and account for, which makes base salaries our best foundation for comparison.

Leadership Team: 22% saving

In other words, the C-suite. We’ll naturally be keeping most of these roles in-house, although there are some areas like legal and financial where we can get a bit creative.

| Role | SF Price (Salary per annum in USD) | Inshore/Nearshore/Offshore Price (Salary per annum in USD) |

|---|---|---|

| CEO | 250,000 | 250,000 (Same) |

| CTO (Senior) | 225,000 | 225,000 (Same) |

| General Counsel (Mid/Senior) | $220,000 | 110,000 (Virtual/On-Demand Legal Counsel) |

| CRO (Senior) | 240,000 | 240,000 (Same) |

| CFO (Senior) | $225,000 | 80,000 (2nd Tier City Virtual CFO) |

| Total spend: | 1,160,000 | $905,000 |

| Total savings: | 22.00% |

Leadership is different from the other categories. Because it does not involve outsourcing, there are no salaries to compare. However, the sections below will include salary comparisons.

Engineering: 81% saving

I’ve talked at length about the benefits of the Latin American educational and career pipelines in tech-related careers, and this rings especially true for engineering. Argentina is a good example of a logical place to build your engineering team.

| Role | SF Price (Salary per annum in USD) | Offshore Price (Salary estimate per annum in USD) |

|---|---|---|

| Back-end Developer (Early/Mid) | $107,000 | $22,000 (Argentina) |

| Front-end Developer (Early/Mid) | $108,000 | $22,000 (Argentina) |

| Full Stack Developer (Senior) | $141,000 | $30,000 (Argentina) |

| Data Scientist (Mid) | $122,000 | $18,000 (Argentina) |

| VP of Engineering (Senior) | $208,000 | $35,000 (Argentina) |

| QA Engineer (Early/Mid) | $86,000 | $14,000 (Argentina) |

| Total spend: | $1,214,000 | $229,000 |

| Total savings: | 81% |

Sales: 23% saving

Sales needs to be primarily onshore, especially when targeting enterprise-level customers. Beyond the practicality of handling in-person meetings, cultural familiarity and networks also matter for these roles.

Also, major metropolitan areas in the US offer an availability of networks. Account executives in specific are like farmers who nurture accounts over time, so they can reside in a second-tier US city. Sales development representatives (SDRs)—such as virtual assistants (VAs), who focus more on the operational side of sales—can be moved to the Philippines.

| Role | SF Price (Salary per annum in USD) | Onshore/Offshore Price (Salary per annum in USD) |

|---|---|---|

| Account Executive (Early/Mid) - NYC | 58,000 | 41,000 (Philadelphia) |

| Sales Development Representative (Early/Mid) - SF | 51,000 | 10,000 (Philippines VA) |

| Sales Development Representative (Early/Mid) - NYC | 47,000 | 0 (Folded into above) |

| VP of Sales (Senior) | 155,000 | 155,000 (Same) |

| Business Development Director (Mid/Senior) | 123,000 | 123,000 (Same) |

| Business Development Manager - SF (Mid) | 93,000 | 93,000 (Same) |

| Business Development Manager - NYC (Mid) | 79,000 | 79,000 (Same) |

| Total spend: | $787,000 | $605,000 |

| Total savings: | 23% |

Marketing: 60% saving

Offshoring is especially good for less time-sensitive jobs such as SEO or paid media. For writing, consider digital nomads in nearshore locations such as Costa Rica as well as Northern UK.

For media, again, we’ll go with** Northern UK.** For demand generation, the Ukraine offers substantial tech talent at a lower price point than the US.

| Role | SF Price (Salary per annum in USD) | Inshore/Nearshore/Offshore Price (Salary per annum in USD) |

|---|---|---|

| VP of Marketing (Mid/Senior) | 127,000 | 90,000 (Virtual CMO Monthly Retainer) |

| Content Writer (Early/Mid) | 63,000 | 22,000 (UK) |

| Demand Generation Manager (Mid) | 105,000 | 25,000 (Ukraine) |

| Marketing Coordinator (Early) | 58,000 | 15,000 (Columbia) |

| Community Manager (Early) | 61,000 | 19,000 (Columbia) |

| SEO Specialist (Mid) | 75,000 | 35,000 (UK) |

| Media Buyer (Senior) | $81,000 | 43,000 (UK) |

| PR Specialist (Mid) | 72,000 | 20,000 (Costa Rica) |

| Total spend: | $763,000 | $306,000 |

| Total savings: | 59.90% |

Product & design: 52% saving

You’ll want to keep your product itself in San Francisco. There will be a certain nuance to product work. In order to understand how the product will be received by your customer base, you need a US-based team that is familiar with the customer profile.

Nevertheless, the functional areas within it—such as design, project management, etc—can go to your nearshore operations in Argentina. There, they’ll be able to work more closely with your engineers on a daily basis.

| Role | SF Price (Salary per annum in USD) | Inshore/Nearshore/Offshore Price (Salary per annum in USD) |

|---|---|---|

| Product Manager (Mid) | 119,000 | 119,000 (Same) |

| Project Manager (Mid) | 108,000 | 21,000 (Argentina) |

| UX Designer (Mid) | 99,000 | 17,000 (Argentina) |

| UI Designer (Mid) | 92,000 | 15,000 (Argentina) |

| VP of Product (Senior) | 172,000 | 172,000 (Same) |

| Total spend: | $1,100,000 | $531,000 |

| Total savings: | 52% |

Operations & HR: $57% saving

Once again, we’re nearshoring to Argentina. As you can see, in this experiment we’ve stripped away a vast number of our US-based employees and essentially set up a sort of delivery center in Argentina.

Since that location already houses the bulk of our staff, it only makes sense to keep operations and HR based there to liaise back and forth with the US office.

Again, the core benefit here is the similar time zone and cost of talent.

| Role | SF Price (Salary per annum in USD) | Inshore/Nearshore/Offshore Price (Salary per annum in USD) |

|---|---|---|

| VP of HR (Senior) | 152,000 | 49,000 (Argentina) |

| Recruiting Manager (Mid) | 73,000 | 15,000 (Argentina) |

| Benefits Specialist (Early/Mid) | 63,000 | 11,000 (Argentina) |

| HR Generalist (Early/Mid) | 67,000 | 67,000 (SF) / 12,000 (Argentina) |

| Director of Operations (Mid/Senior) | $123,000 | 25,000 (Argentina) |

| Operations Manager - SF (Mid) | 79,000 | 79,000 (Same) |

| Operations Manager - NYC (Mid) | $70,000 | 19,000 (Argentina) |

| Assistant Operations Manager (Early) | 51,000 | 51,000 (SF) / 11,000 (Argentina) |

| Total spend: | $796,000 | $339,000 |

| Total savings: | 57.40% |

Finance: 76% saving

We’re going to outsource this completely based on a virtual CPA model. Usually, virtual CPAs operate in second-tier US cities. I’ve selected Indianapolis for our financial operations. In terms of cost, you won’t be paying the rates for a CFO that would be based in San Francisco. (This is based on contract work, not full-time.)

| Role | SF Price (Salary per annum in USD) | Inshore/Nearshore/Offshore Price (Salary per annum in USD) |

|---|---|---|

| Senior Tax Specialist (Mid) | 106,000 | 0 (Virtual CFO) |

| Accounts Payable Specialist (Mid) | 57,000 | 0 (Accountant) |

| Accounts Receivable Specialist (Mid) | 53,000 | 0 (Accountant) |

| Compliance Manager with Internal Audit Skills (Mid/Senior) | $116,000 | 0 (Virtual CFO) |

| Accountant - SF (Senior) | 0 | 80,000 (Replace Payable and Receivable) |

| Total spend: | $332,000 | $80,000 |

| Total savings: | 75.90% |

Grand Total: 51% saving

| Onshore | International | |

|---|---|---|

| Total salary spend | $6,152,000 | $2,995,000 |

| Total savings: | 51.30% |

“50% off sale.”

That’s effectively what we’ve achieved here, in terms of lowering our costs for labor. It doesn’t require packing up shop and moving your whole operation to a famously low-cost location like the Philippines; the best outcomes are achieved by matching the right division of your business to the right labor market.

Moreover, we’ve done it without sacrificing quality. And as a bonus, it turns out a lot of your operations can go to the same nearshore location (Argentina) and still function effectively.

Mixed in-house/out-of-house models really work—sometimes even better than traditional models. In engineering, for example, you may actually find better talent nearshore or offshore than onshore when it comes to more niche, technical skills. Moving those functions to a location with an abundant talent pool can only give you a huge competitive advantage.

Hybrid business structures aren’t new. Big corporations have been utilizing this strategy for decades. But in the future, I expect to see a rise in smaller companies experimenting with the possibilities it allows.

Best Places to Offshore SEO Services

Best Places to Offshore SEO Services