The difference between revenue and income is that revenue represents the total amount of money generated by a business before subtracting expenses. Income is the total profit that a business has after all the expenses are deducted from the revenue.

Revenue is often called the top line of the business, as it is the first line you see when looking at an income statement. An income statement is a document that has the complete calculation from revenue down to income. If you want to plug in your own numbers and see the breakdown, try our revenue vs income calculator.

Income is also referred to as the business’s bottom line as it is the last line on an income statement. It is important to note that income is not the same as gross profit or a few other terms you might have seen, but more on that in a second.

The simplest way to understand revenue vs income is by understanding the total summation of your expenses between each term.

But before getting started, let’s lay out the three key financial terms. Each term can also go by a few other names. To keep it simple, I will use revenue, gross profit, and income. A few terms you may hear or see elsewhere are referring to the same thing, these terms are:

- Revenue = sales, gross sales, net revenue, or top line

- Gross Profit = sales profit, gross income, or gross margin

- Income = net income, net earnings, net profit, or bottom line

By the end of this article, you should feel more comfortable with these terms and the fundamentals of calculating your income. You will also understand how startups like WeWork and Uber reported huge revenues of hundreds of millions of dollars but still had a negative income.

The difference between revenue vs income

The term revenue refers to the total amount of money generated from either selling a product or offering a paid service. Income is the final step in calculating your income statement, as it is the profit or loss you have after subtracting all expenses.

For revenue, it is purely the cash your business has taken in a specific time range. The IRS has over 700 pages describing the accounting rules for revenue, but let’s keep the definition simple.

When calculating your income, the expenses typically start with the cost of goods sold, which can be a variety of expenses depending on the nature of your business model. I will go deeper into the cost of goods sold in a minute.

Individually it’s vital to understand the fundamentals of revenue vs income and how each indicates certain functions and levers within your business.

Income Statement example in Google Sheets: Revenue vs profit vs income

Here is a short and straightforward template of an income statement that shows the full journey from the top-line revenue down to the bottom-line income. Looking at an income statement, the difference between revenue vs profit vs income becomes more evident.

The income statement template in Google Sheets

What is revenue in business?

Depending on your business, your revenue could come from several different sources. Generally, businesses generate revenue from selling a product or service. How your business earns money is commonly referred to as the revenue model.

The primary means of how your revenue model makes money is the operating revenue.

For a company like Nike, their operating revenue is primarily earned from selling products, like shoes and clothing.

A subscription business like Netflix or most SaaS companies charges customers a monthly fee to use their service.

Larger companies like Amazon or Google can have multiple revenue streams. For example, Amazon earns revenue on the commission of items sold through its e-commerce site and monthly subscriptions from sellers and buyers.

Non-operating revenue is any type of cash that is not from the core operating revenue category. Which could be interest earned on money the business has in the bank, sale of assets in a one-time deal, or earnings on dividends the company may be holding.

What is accrued revenue?

Accrued revenue is the money you have received but have yet to report as revenue. Accrued revenue is commonly used for any business with a subscription revenue model. In accrual accounting, you can report the cash into your revenue every month as the service is provided to the customer.

For example, if I had a subscription service that offered users to pay on a twelve-month plan, I could report to collect that money all at once and declare it as a single lump sum.

Alternatively, for accrued revenue, I can spread the revenue evenly across the twelve months. As each month passes, I report one-twelfth of that lump sum into my revenue. This accruement works well when users are churning from the service and asking for their money back. In accrual accounting, a customer churning affects my future revenue reporting, not my past.

Considering these users who pay for a twelve-month subscription, the subscription business can roughly calculate the amount of money they intend to accrue over the next twelve months.

What is Income?

Income is revenue minus all of your expenses. To calculate your business’s income, you first need a complete accounting of all of those expenses so you can subtract them from your revenue.

If you were only to subtract the cost of your goods sold from revenue, you would not have the bottom line income; instead, you would have the gross profit of your business. So before I begin discussing income, let’s break down the cost of goods sold and how that creates gross profit.

How to calculate the cost of goods sold

Cost of goods sold (COGS) is any direct expense involved in creating the product or service. For a traditional e-commerce company selling physical products, their COGS formula would look like this:

Cost of Goods Sold = Beginning inventory + Purchases – Ending inventory

Where beginning inventory is the number of products in dollars I have from the last period, purchases are the new product inventory added in this current period, and ending inventory is what I have left at the end of the period.

For a service-based company without physical products, COGS could mean the payroll for the person providing the service, like Uber paying its driver to transport customers and direct expenses for keeping the app up and running.

For a SaaS company, this could be web hosting and any other third-party apps needed for the service, website development, support costs, or paying employees directly for the production and delivery cost of the SaaS product. For example, a SaaS company like Zoom would have significant costs web hosting all of those video calls.

The COGS for tech companies are usually unique to the nature of the revenue model and can vary from one business to the next. Once you have identified the contributing costs to your COGS, you will also better understand your options or levers to minimize these costs down the road.

Profit vs Income

Now that you know how COGS is calculated, you can subtract that expense from your revenue to create the gross profit. Gross profit vs income is still a bit different, but we are getting closer.

Gross profit is important in its own right because it indicates how efficient the core function of the business is. Is the core expense of your product or service larger than the revenue it is making? If this answer is a yes, then the business has some issues, and you will need to lower your COGS, raise your prices, or raise more capital.

Figuring out your gross profit can also be referred to as the gross profit margin or gross margin ratio. To turn this into a percentage, you can use the below equation:

Gross profit margin = (revenue - COGS) / revenue * 100

For example, a company with yearly revenue of $500,000 and a COGS of $350,000 would complete this calculation:

Gross profit margin = ((500,000 - 350,000) / 500,000) * 100

The result would be a gross profit of 30%.

How to calculate operating profit for a startup

With your gross profit calculated, we can subtract more business expenses to get closer to the income. These expenses are called operating expenses (OPEX) and vary on a broad spectrum of costs depending on the business.

Some of the most common operating expenses can include:

- Marketing and sales

- Tech expenses (SaaS subscriptions, hardware)

- Research and Development

- Payroll

- Additional labor costs (contractors)

- Office Rent

- Insurance

By subtracting these costs, you will have created your operating profit. This calculation is also known as earnings before interest and taxes (EBIT).

Taxes and interest are excluded from this calculation because you have little control over these two expenses. EBIT is purely a calculation of how well or profitable your business is without any of these non-operating expenses taken into account.

For most investors, the gross profit and operating profit are two calculations they are most interested in viewing. From here, they can see how much you are spending on each part of your business and how viable your revenue model is. Historically companies like WeWork might do some creative accounting and move costs out of the operating expenses category to seem more profitable than they are.

A quick note, you may sometimes see the acronym EBITDA, which also includes depreciation and amortization. This calculation is used for companies with significant assets that can depreciate over time, like factory machinery.

Calculating your Income

Once you have your operating profit, you can then subtract the applicable tax rate for your business. Each state has a different tax rate, and the federal tax rate for US resident corporations is currently 21 percent. Some locations popular for international business incorporation owe their popularity to low, simple corporate tax rates. Singapore, for example, is set at 17%.

At this point, you would also deduct any interest payments on debts or loans the business has. The result is your bottom line income, the amount of income your business made once all expenses have been accounted for.

How to differentiate between revenue vs income

This article outlined the most fundamental differences between revenue and income by outlining a few accounting fundamentals and the income statement. By understanding your expenses and subtracting them from revenue, you will eventually reach your income. This process is best outlined by writing out your income statement.

Key terms to remember for revenue vs income

By working through this process, we identified some other key financial components. Some of the key terms I touched on are:

- Revenue: The total amount of money generated by a business before any subtractions are made. It can be divided into two categories, operating and non-operating revenue.

- COGS: The cost of goods sold is any direct expenses that create the business’s product or core service.

- Gross Profit: Gross profit is your total revenue subtracted by the COGS.

- Operating Expenses & EBIT: Take your gross profit and subtract your operating expenses to get your earnings before interest and tax.

- Income: Income is the bottom line after you have subtracted any taxes and interest payments.

Important information for calculating income

In this article, I only scratched the surface of financial terminology and concepts. If you need to structure your business’s income statement, I implore you to do a more extensive reading as real-world financial statements can be several magnitudes more complex.

I recommend reading chapter six of Financial Intelligence by Berman and Knight to appreciate the complexity of financial documentation.

With what you have learned by reading this article, you should be well equipped to explore deeper into the minutia of your business’s financials.

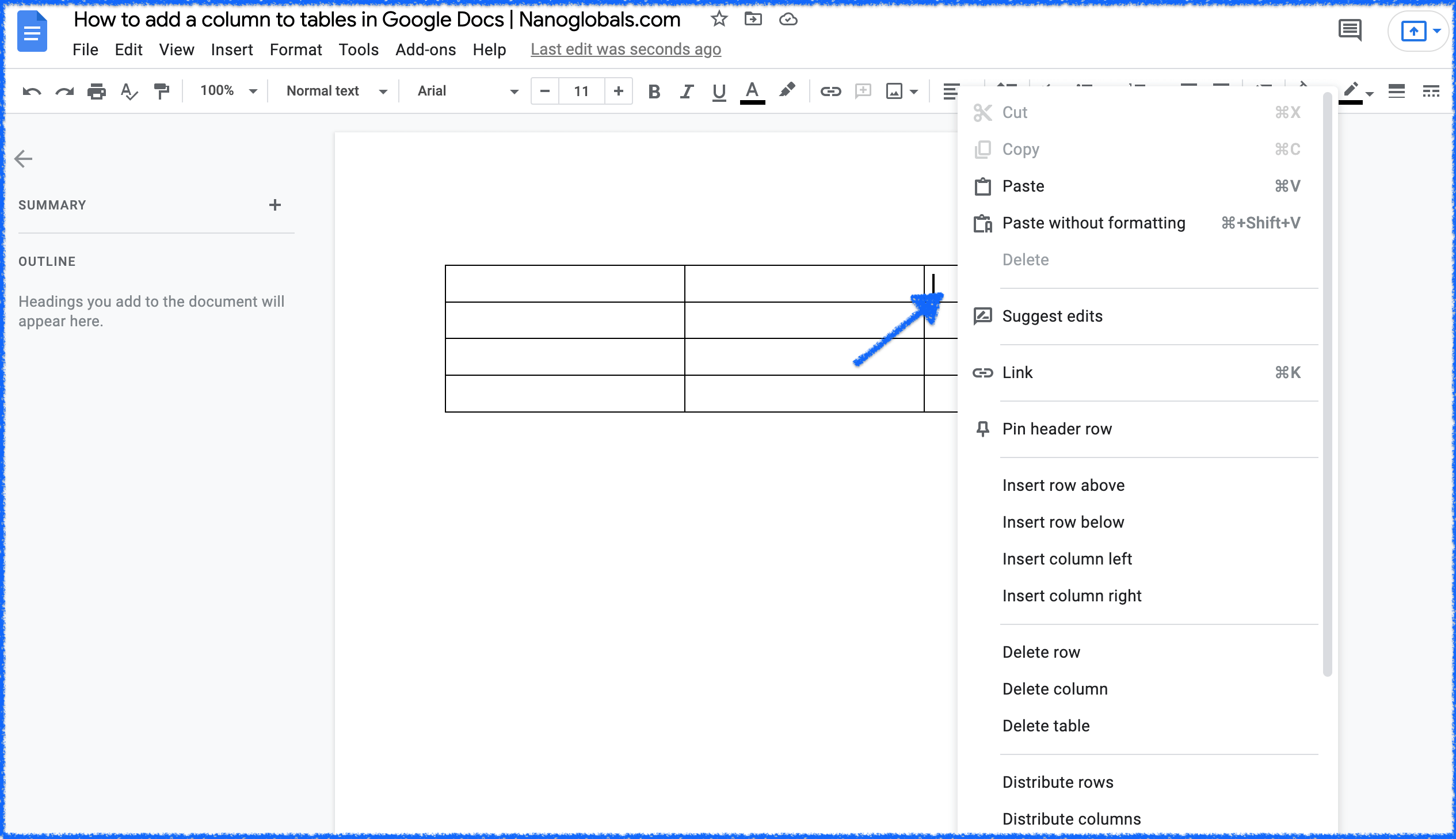

How to add or delete columns in Google Docs tables

How to add or delete columns in Google Docs tables